In January 2022 McKinsey published a report The net-zero transition, and its subheading said “What it would cost, what it could bring”. I was immediately hooked on the words “McKinsey” (usually nice charts) and the “what it would cost” part, because I don’t know the answer and it bothers me.

In the report, they calculated what would have to be done to achieve net-zero with 1.5°C warming, and the numbers are impressive. An annual average increase in spending on energy and land-use assets would be around USD 3.5 trillion, which is a quarter of all global tax revenue, or 7% of household spending. This is probably the absolute minimum amount we should anticipate. A non-optimal path to decarbonisation may increase these costs. Another suboptimal strategy would be neglecting to redirect an estimated one trillion USD towards low-emission assets, which would push the total to USD 4.5 trillion.

In the scenario they built for 2050, power comes from wind, hydro, solar, and biomass. Steel comes mostly from hydrogen with a large share of carbon capture and storage. Cement is unsurprisingly mostly CCS. Cars use batteries and fuel cells. Buildings use mostly heat pumps and some – presumably renewable – district heating. Seems logical, except a section discussing nuclear energy would be a valuable addition.

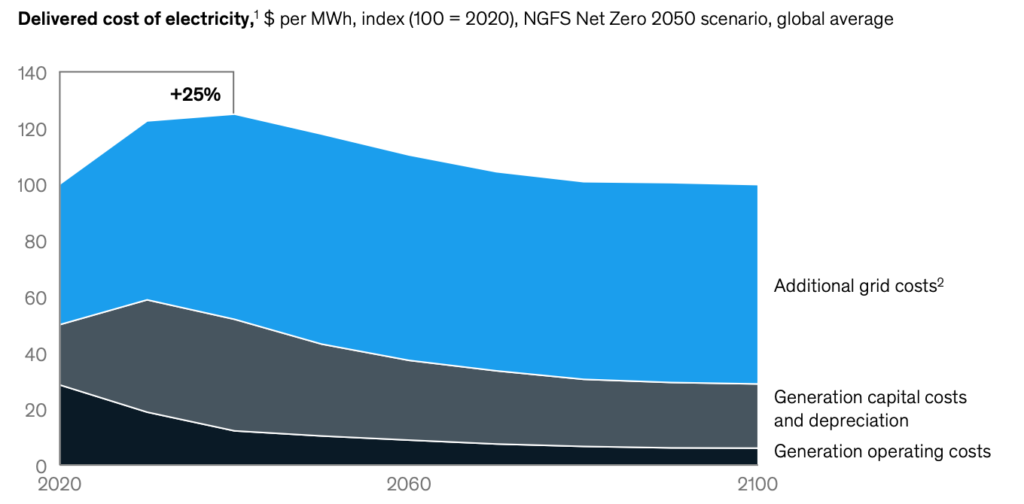

So, if all goes really, really well, power will be 20% more expensive in 2050 in comparison with 2020. Steel – 30%, cement – 45%, cars – internal combustion 20% more expensive, battery electric – slightly more expensive than internal combustion today.

One curious thing is that power will be more expensive even though wind turbines and solar panels are not particularly costly on their own: transmission, distribution, and storage are the expensive bits.

Go read the report – it’s written very well. And buy McKinsey consulting if your organisation can afford that so they keep making these reports.